Proper small business bookkeeping allows you to remain on top of your company’s finances, allowing you to make sound financial decisions that will help your company grow.

Create a new business account, budget for taxes, organize your documents, and leave an audit trail. We will highlight the key terms and practices of bookkeeping in this blog.

What is Bookkeeping?

Bookkeeping is the process of tracking your company’s financial transactions so you can see exactly how much money you’re generating and where it’s going. It is the day-to-day recording of financial transactions and aids in ensuring that individual financial transaction records are accurate and up to date.

Roles involved in Small Business Bookkeeping

As mentioned above, bookkeeping manages a company’s daily finances. Some of the primary tasks of a bookkeeper include:

- Paying bills (e.g., bills).

- Client and customer payment collection.

- Ensuring that the appropriate tax amount is paid.

- Reclaiming tax for your company (e.g., expenses).

- Managing payroll to pay your employees.

Keeping accurate records is essential for financial reporting and is critical if your company is subjected to an audit.

Why is Small Business Bookkeeping Important?

Bookkeeping is critical to the long-term viability and profitability of any small business. Primarily, you must have a precise image of your company’s financial ins and outs. Understanding the health of your business’s finances, from cash on hand to obligations owed, allows you to make smarter decisions and prepare for the future.

Accurate bookkeeping also safeguards your company from blunders and tax penalties and quickly detects fraud. Additionally, it saves you time. Effective accounting streamlines your company’s financial activities, from payroll taxes to invoice management. It protects you from spending time tracking down every dollar.

An easy and convenient way to do this is to implement a small business ERP or business management solution for your business operations. These consist of a unique set of various solutions in one consolidated platform. With the help of these systems, you can not only record your financial transactions at ease but also manage your business tasks all in one place.

Essential Terms for Small Business Bookkeeping

Below are the most basic bookkeeping terms you should know to begin with your small business.

- Balance Sheet: A thorough report which summarizes your company’s financial situation. Its purpose is to demonstrate what your company owns and owes.

- Accounts Payable: Accounts payable is the account that keeps track of all the money you owe to a third party.

- Accounts Receivable: On the other hand, this is the account that maintains track of all the money that third parties owe you.

- Assets: All the items you or your firm own to support the successful operation of your business are collectively referred to as assets. It can include cash, land, tools, automobiles, and furnishings.

- Capital: This is merely the money or other assets a business owner personally holds as opposed to the actual profit generated by your business or self-employment.

- Costs of Goods Sold: This includes money spent on developing the product or services.

- Depreciation: Depreciation occurs when an item loses value over time due to wear and tear. Depreciation is the measurement of a reduction in value.

- Equity: The money you invest in a business as the owner, plus all the accumulated earnings, is referred to as equity. Your equity as a small business owner is recorded in a capital account.

- Expenses: This includes any money spent on running your business that isn’t directly tied to selling goods or services.

- General Ledger: A general ledger account is where you keep, categorize, and summarize all of your transactions. The public ledger contains these accounts, the balance sheet, and the income statement.

- Income Statement: The financial statement describes your financial activities during a specific period. It evaluates your net profit or loss after calculating your income, costs of products sold, and expenses.

- Journals: Journals are where bookkeepers keep track of their everyday transactions. You’ll have individual journals for each active account you utilize, such as cash, accounts payable, and accounts receivable.

- Liabilities: Liabilities are basically all of your debts. This might include everything from loans you’ve taken out to unpaid bills.

- Payroll: This is how you pay your employees as a small business owner. It’s a key element of bookkeeping and entails submitting payroll details to the government. This comprises taxes you must pay on behalf of employees, as well as remuneration and other benefits.

- Revenue: Revenue is the money you make from selling your services and items. Some businesses may generate income in unconventional ways, such as by selling assets the company no longer requires.

- Trial Balance: Trial balance ensures that your books are balanced before compiling all of the critical information for financial reports and closing the books for the accounting period.

Bookkeeping for small business: 9 Things to do

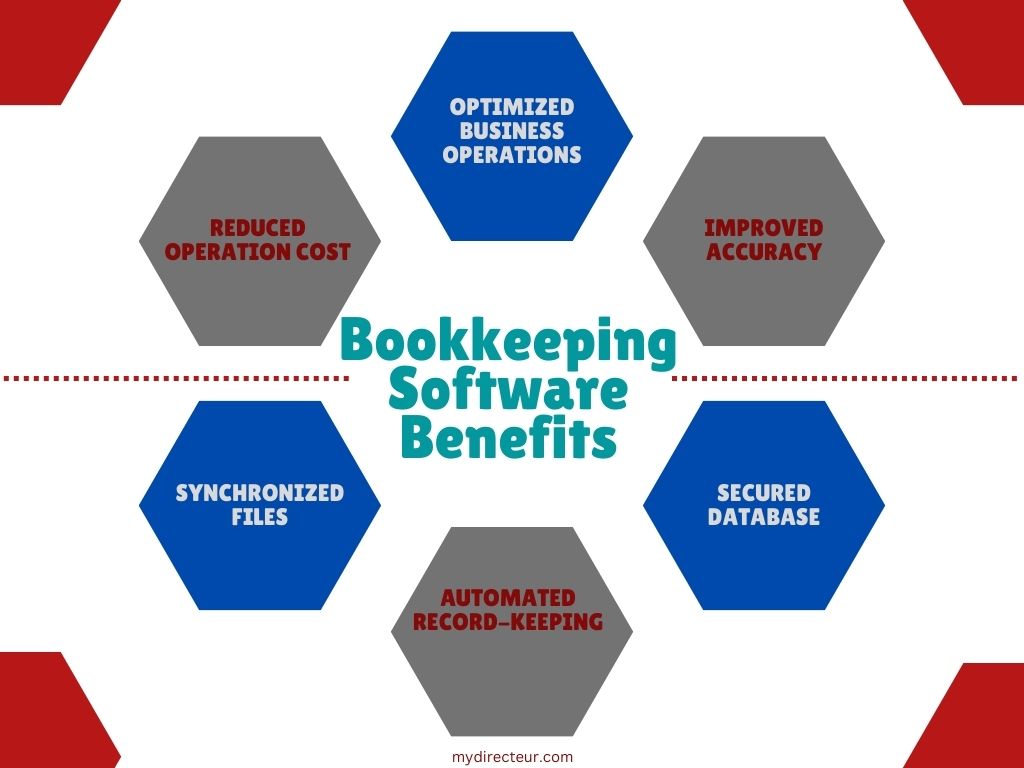

1. Start Using a Small Business Bookkeeping Software

Making Tax Digital is a new government initiative. Taxation is going digital, which is positive since you won’t have to store mountains of paperwork and receipts since you can complete year-long books in minutes.

Digital software, such as MyDirecteur, allows you to keep your incomings, outgoings, and everything in between organized, making it easier to maintain your financial data. While finishing your books may seem like an additional burden, many platforms offer basic and easy-to-use features that make the entire process quick and painless.

So you don’t have to feel overwhelmed since accounting software will make completing your books much easier, providing you with more peace of mind.

2. A New Business Account

Nothing is more inconvenient than having to go through too many statements to uncover one little but critical piece of financial information. If you haven’t yet segregated your personal and business money, they will always mix in one account, making it simple to lose track.

You must keep your personal funds and professional operations distinct by creating a new bank account and ensuring no misunderstanding between the two. This way, you’ll have no trouble locating the necessary financial data when it is time to prepare your books.

3. Set a Budget for Tax Purposes

By planning in advance for tax payments, you can avoid paying an enormous amount all at once. If you have a savings account, set aside a little portion of your income to quickly pay off your tax obligation while knowing you have money saved.

4. Regularly Organizing the Records

Crowded records make bookkeeping much more complicated, especially when you keep personal and company funds in one account.

When your records are well-organized, you can quickly locate things, saving you a lot of time. If you’re pressed for time and nearing tax deadlines, you’ll be glad you took the effort to maintain your documents neat and organized, so you know precisely where to look.

However, ensure that you maintain your data in a structured way all the time, not just occasionally.

5. Track Your Expenses

Tracking company expenses can be challenging, but utilizing a business credit card, for instance, can ensure that all of your expenses are kept together and documented. Organizing your bills into various categories of expenses is the simplest way to do this.

As an example, consider automobile usage. If you travel long distances for meetings, you should measure your mileage, distance traveled, and other associated costs.

6. Maintaining Daily Records

Keep daily records; this is one of the most fundamental guidelines to follow. Implement and stick to a system so you can keep correct records daily and avoid mistakes while preparing your tax returns.

7. Audit Trail

If you do your books manually, you must have an audit trail. If you can rapidly retrace your financial activity, your record-keeping will be considerably easier. That is why software is a fantastic alternative to explore.

An audit trail ensures that your invoices are in order and that you can quickly retrace your actions in case of minor errors.

8. Keep Track of Your Receivables

Late client payments can be inconvenient and negatively impact your cash flow. Receivables are due at specific times, so pay attention and quickly act when they are due. Try to devise a strategy to receive the money as soon as possible. The longer you wait, the more damage it will do to your cash flow.

9. Remember Tax Deadlines

For everyone, a tax deadline can be stressful. Make the easy step of reminding yourself so that you have enough time to complete your tax returns without making any mistakes. Maintaining correct records may ensure that your returns are submitted on time and avoid any unfavorable penalties.

Conclusion

Whether you use software or hire an expert, learning the fundamentals can help you better manage your money. You’ll save time tracking down receipts, avoid costly blunders, and obtain vital insights into the potential of your business.

A prosperous business relies on accurate bookkeeping. After all, if you know how much money you’re making or where it’s going, it’ll be easier to devise strategies to increase your profits. Small-business bookkeeping might be stressful if you’ve never worked with finances before. Fortunately, most small-business bookkeeping software is designed primarily for non-accountants. (If you’re starting, a free trial of bookkeeping and business management software can help you save money.)